Taxes • March 18, 2024

Blog

Blog • Tips • February 23, 2022 • Team Truly

Share This

Wire transfer is one of the most popular methods of moving money worldwide. Whether you need to pay your suppliers, pay your contractors or pay employees abroad, how much do you really know about wire transfers, the actual process of wiring money, and wire transfer risks?

Whether you’re sending money to your family overseas or sending international business payments, it’s important to know if your wire transfer services are in good hands.

Here are the top 10 things you need to know about wire transfers, so you can start sending payments without stress.

A wire transfer is an electronic transfer of funds from one person or corporation to another business or individual. In other words, money is transferred from one bank or financial institution to another, wherein the sending and receiving bank follow a set of financial protocols to ensure the funds are deposited to the intended recipient, without having to rely on having a common banking infrastructure between the sender and the recipient's banks, even if they are in different countries.

Typically, you will need to visit your bank and fill out a form with the following information:

Note that each country has a different way of routing funds to the correct account, for example:

The SWIFT Code of the receiving bank/branch is the most important piece of information that is needed in case of international wire transfers. It ensures the money reaches the intended bank which can then internally route it to the correct account using the recipient’s bank account number.

It may be worth calling your bank in advance to double-check exactly what your branch requires, as some may seek additional information. Some banks also require a different SWIFT code to be used depending on what currency you are receiving funds in.

For example, sending wire transfers to a recipient account at Bank of America in USD will require a different Bank of America Swift Code compared to when you send a wire transfer in a foreign currency to the same bank, as explained in their FAQ. Hence it is important to pick the correct Bank of America routing number when sending them a wire transfer in different currencies.

Similarly, when sending wire transfer to Chase, you must have the correct SWIFT code for Chase bank, which you can find on the Chase wire transfer page. They also adivse you to use the Chase SWIFT code when asked for an IBAN number, since Chase does not support payments to IBAN numbers.

It is easy to miss which SWIFT code is required forwhich currency, hence ample caution is advised when sending a wire or when you send money online to recipients at one of these banks.

You may also want to check ahead to see what wire transfer fees your bank will charge you per transfer.

Wire transfers can be:

a) Domestic: Sent locally between accounts within the same country. In the United States these wires are more commonly known as Fedwire.

b) International: Sent to a bank account that is based in another country. Globally these wires have come to be known as SWIFT (short for Society for Worldwide Interbank Financial Telecommunication) wire transfer based on the SWIFT code that is used for routing funds.

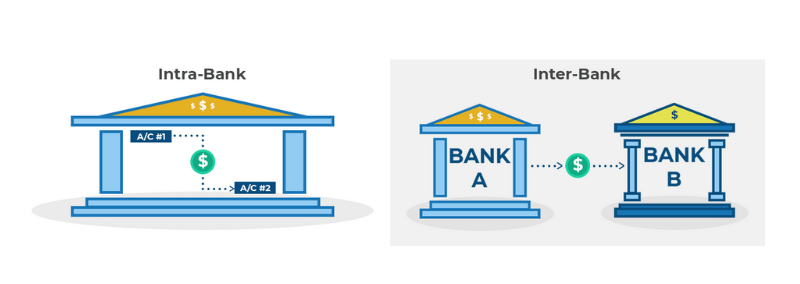

Both domestic and international fund transfers can be broken down into two additional sub-categories:

- Intra-Bank: Transferring between accounts within the same bank. This is also known as EFT (Electronic Funds Transfer) or ACH (Automated Clearing) in several countries.

- Inter-Bank: Transferring from an account with one financial institution to an account with another. Wire Transfer is one of the most common (though not the only method) used for transferring money from one financial institution to another.

Wire transfers are sent using internal networks that connect banks. Think of the networks like a messenger that’s going between banks in an electronic money-sending transaction.

These networks don’t actually handle any money, but instead, act as the secure pathway for sending international money orders from one bank to another.

Intra-bank Electronic Fund Transfers

Both the sender and the recipient of the transfer belong to the same bank.

The bank’s software is instructed to transfer funds between its accounts or branches.

Simply put, money is removed from one account and added to another.

Inter-bank Wire Transfers

The sender and recipient of the transfer belong to different financial institutions.

Banks are members of a secure, closed network that collects and settles intra-bank wire transfers.

Money is removed from the sender’s bank account and then added to the recipient's account. Examples of networks: RTGS, ACH

Intra-bank

Some big banks have branches in several countries, while some banks have accounts of their own (Nostro Accounts) in foreign banks.

The SWIFT network is the network that banks typically use for these transactions. This means that transfers can be sent without using an intermediary bank.

Inter-bank

Not all banks own accounts in banks overseas. This is when an intermediary bank is used. It essentially acts as a pit stop for the payment on the way to its final destination.

When this happens, the payment must pass through compliance regulations in the country of the sender, the intermediary bank, as well as the recipient. These additional requirements can result in a slightly longer process than other wire transfer services.

Transfer wire payments can be tricky but when you are armed with accurate information as needed by the bank, you can be sure that your payment will go through smoothly.

Different local networks can be used for this payment type for originating and payout, depending on the location of the banks involved.

Examples of networks by country:

| Domestic Wire Transfers | |

|---|---|

| Intra-bank | Inter-bank |

|

|

| International Wire Transfers | |

|---|---|

| Intra-bank | Inter-bank |

|

Canada & U.S: ACH Europe: SEPA India: NEFT / IMPS / RTGS |

There is no denying that wire transfers can be expensive. Domestic wire transfers, on average, cost upwards of $12 per transfer, but can go up to $30.

International wire transfer services usually cost between $18-80, although you can expect some additional wire transfer fees for accepting incoming payments from certain countries.

Wire transfers may not always be cheap, but the good news is that as long as you track them, you can actually claim them as business expenses at the end of the year when you file your company’s taxes. There are lots of useful expenses you can deduct - for more suggestions check out our blog on Small Business Tax Deductions.

The time taken for a domestic or local wire transfer depends to a great extent on the capabilities and correspondent bank network of the sending bank. If the sending bank is a small credit union or regional bank, they may depend on the service of a larger bank like Wells Fargo wire transfer services, to deliver the funds to the recipient bank. Typically the domestic wire transfer is completed in the same business day but when dealing with smaller banks it may take upto one business day.

International wire transfers can take anywhere from 3-5 business days, but it’s not uncommon for them to take a week (or more!).

These processing times differ because a domestic wire transfer goes through a domestic network, and international wires also have to clear their overseas equivalent, which can add additional time to the process. Here are some of the most common reasons for delays in international wire transfers:

Every once in a while an international wire transfer will get stuck for an indeterminate time when the participating banks or intermediate banks are not able to synchronize their systems with respect to the status of funds or when they are unable to accurately identify the recipient’s bank account due to incorrect or missing information in the wire transfer.

Thankfully, there are some institutions like Truly Financial, that can provide easy, reliable wire transfer services to a host of countries.

This helps cut down on how long a wire transfer does take to complete, as well as minimizes fluctuating wire transfer fees. Modern institutions like Truly Financial were designed for small business banking to handle small and large value payments efficiently by eliminating hefty bank fees that are charged by larger banks. These modern institutions also use newer technology like SWIFT GPI which reduces the time taken for wire transfer processing and enables faster and more accurate tracing should anything go wrong.

Wire transfers are quite secure, but they do carry some risks.

Since wire transfers require the recipient’s bank account number and a network code or SWIFT code, any errors in these numbers (such as incorrect digits) can sidetrack your transfer, or result in it being deposited into the wrong account.

Since wire transfers require the recipient’s bank account number and a network code or SWIFT code, any errors in these numbers (such as incorrect digits) can sidetrack your transfer, or result in it being deposited into the wrong account:

In these cases, it can take weeks to recover the money, and sometimes you may not get it back at all. This is especially true if the erroneous wire transfer has passed through multiple intermediaries.

As such, you need to be careful when entering the information you’ll be using with your wire transfer services. You should also use a financial institution you trust, that you know has security features in place to protect your wire transfer from unforeseen issues in the delivery and payment settlement process.

Most of the time, wire transfers are completed smoothly and successfully, but occasionally you may face an unexpected hiccup. Thankfully, you can trace your wire transfer services throughout processing to ensure it’s completed properly.

This way, if something unexpected occurs, you can have your bank step in quickly to help rectify the issue.

Senders:

When you send a Fedwire or local U.S. wire transfer, you get a Federal Reference Number as the confirmation of your transaction. You can contact your bank to track your wire transfer, and they’ll use your Federal Reference number to trace it.

They’ll be able to see the transactional details between your bank, the corresponding bank into which funds are being deposited, as well as identify the wire transfer’s current location.

If you notice your wire isn’t being posted to the correct account, you can request a wire recall. In this situation, your funds are transferred back into your account. Ideally, this should always be done before funds end up in the wrong account, as it becomes more challenging to retrieve them once they’ve been credited to another account. Your bank can attempt to retrieve it on a best-efforts basis only, once it is paid out.

For international wire transfers or cross-border wire transfers, you get a SWIFT Reference Number from your bank if you request for it. The reference number can also be used by the beneficiary’s bank to trace if they should have received the transfer but did not. When requested, the sending bank is obligated to provide the SWIFT MT103 payment confirmation to the sender. MT103s is a globally accepted proof of payment and includes all required information such as transfer date, amount, sender and recipient information.

Remember, whenever you initiate a wire trace, your bank would usually charge you a fee for tracing the wire transfer. Therefore it makes sense to request a trace or a recall only if you’re absolutely sure that the beneficiary did not receive the funds after a reasonable number of days.

Recipients:

If your wire is taking longer than it’s supposed to and you’re starting to become concerned, contact the sender to acquire the following info:

- The Federal Reference number or SWIFT Reference Number attached to the transfer

- The SWIFT number for the bank of the sender

- The date the transfer should have been available

- The currency and exact amount of the transfer

Your bank can then use this information to determine if a wire deposit to your account is pending.

If your bank can’t locate the wire, notify your transfer sender so they can check their transaction. As mentioned earlier, you can also initiate a wire trace to locate the funds if necessary.

Truly Financial allows you to track all of your ongoing wire transfers quickly and easily. Since we offer convenient worldwide wire transfers, we can also reduce the time wire transfers take compared to other financial institutions.

With Truly Financial you never have to worry about additional bank fees for tracing a payment or recalling a wire transfer. Trace as well as recall are offered free of charge but of course, can be done only on a best effort basis.

Some businesses that aren’t banks offer wire transfer services as well. For example, one well-known company that provides wire transfers is Western Union.

Some may think that because they’re not using a traditional wire transfer, they’re using a better alternative. Unfortunately, that’s not usually the case.

A non-bank wire transfer may process slightly faster, but their wire transfer fees will be much higher than using a bank.

There are also some non-banks that offer digital services (or e-wallets), where you set up an online account that acts as an intermediary between the banks of your transfer. Paypal is a prime example of these types of wire transfer services.

Paypal charges an extremely high percentage for currency conversions when making international payments compared to banks, and it can often take a week or more before the payment is complete.

On the other hand, Truly Financial provides convenient, affordable wire transfer services across a huge number of countries. And best of all, when you send wire transfers to vendors that are also using Truly Financial, they receive your payment in one business day.

There is a wide selection of other payment options available through Truly Financial, in addition to wire transfer services.

Not only can you send one-day payments to any of the 50 countries in Truly Financial’s Express Network, but you have the option of sending local domestic payments in the United States and Canada through EFT and ACH as well.

We believe in taking back the power from big banks and putting it in the hands of small businesses owners. Now you can avoid high bank fees and scale your companies while reducing the time spent waiting on transfers and vendor payments.

You can even easily delegate payment responsibilities to others on your team, so you’ll be able to focus your attention on other valuable areas of improvement and growth for your business.

Are you ready to join the better business banking revolution?